Installment loans incur a part of the entire loan cost for every month you've an outstanding stability. If you repay the overall from the principal of the installment loan early, you will not be needed to spend loan expenses which have not posted for subsequent months. For each loan that you simply just take, you will note the applicable loan fee before you decide to go ahead and take loan. When you take the loan, the loan costs that apply to that loan never alter. We reserve the correct to alter the loan service fees that we provide you with For brand new loans Anytime. American Convey reserves the proper to supply promotions to scale back or waive loan costs every so often. Not all buyers is going to be eligible for the lowest loan fee. Not all loan time period lengths can be obtained to all buyers. Eligibility is based on creditworthiness as well as other factors. Not all industries are qualified for American Specific® Business Line of Credit. Pricing and line of credit decisions are determined by the general economical profile of both you and your business, together with record with American Specific as well as other monetary institutions, credit background, together with other variables. Lines of credit are subject to periodic evaluate and will modify or be suspended, accompanied with or with no an account closure. Late fees might be assessed. ¹The needed FICO score might be bigger based upon your romance with American Convey, credit historical past, and various elements. Loans are issued by American Categorical Countrywide Lender.

Larger earnings also raises your borrowing likely, due to the fact lenders desire to see dependable earnings. Placing up collateral could Supply you with extra favorable terms at the same time.

Business lines of credit desire premiums tend to be bigger than standard time period loans, particularly when the line is unsecured. This business financing possibility best suits small-phrase desires, rather then main investments like purchasing home or highly-priced equipment.

Moreover, preserving a healthful financial debt-to-profits ratio and demonstrating consistent cash move can reinforce your situation. A powerful credit profile increases your odds of loan approval and could result in more favorable conditions and fascination charges.

Throughout the lifetime of one's business you might have to secure outside the house funding. Study standard and choice financing choices that will help you attain your plans.

Best line of credit for small businesses and begin-ups: Fundbox Fundbox is actually a fintech that makes capital accessible to businesses via business loans and lines of credit originated by First Electronic Financial institution or Guide Lender. Best for businesses searching for flexible repayment terms: Ondeck Ondeck is actually a fintech aiding borrowers uncover ideal financing employing partnership associations. Very best for business house owners on the lookout to purchase inventory employing a line of credit: Headway Capital Headway Capital just isn't a financial institution but instead a fintech operating as being a small business lender. Ideal line of credit for businesses in company-centered industries: Fora Money Fora Economical Business Loans LLC is really a fintech and never a bank. Most effective line for recognized businesses needing quick-time period financing: American Specific American Express is actually a fintech running as a financial support service provider and collaborating with other fintech associates. Very best business line of credit lenders speedy comparison

You do that through your browser (like Netscape Navigator or Net Explorer) options. Just about every browser is a bit diverse, so look at your browser Enable menu to find out the proper way to change your cookies.

Overestimating can lead to unwanted financial debt, though underestimating could possibly leave your business short of money.

It's also possible to think about an SBA line of credit throughout the SBA CAPLines system. An SBA revolving line of credit provides short-expression financing that can achieve nearly $five million with repayment terms of up to 10 several years.

The repayment conditions of lump sum loans fluctuate. Some lenders involve swift repayment in six months, others extend to 5 years or maybe more. Ensure that to barter phrases that fit your finances.

Financing your business is becoming less complicated than ever before with numerous business lenders and platforms offered. From SBA loans to how to get a business loan for equipment business lines of credit, companies can submit an application for lots of varieties of business loans on the market. Get started Using the most often asked questions about business loan solutions.

Throughout the lifetime of your business you might have to secure outside funding. Learn about traditional and choice financing alternatives which will help you reach your targets. Disponible en español

Your credit line equals your deposit with the choice to graduate to an unsecured line of credit above timeadatext

During the total procedure I actually felt that they ended up on my team, supporting me to obtain this completed, wanting me to realize success, As well as in my corner.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Jeremy Miller Then & Now!

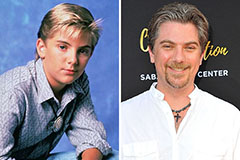

Jeremy Miller Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!